About

Unlocking and accelerating climate finance at scale.

Mission

The Climate Finance Access Network (CFAN) is an agile, demand-driven initiative that offers a practical and actionable solution to developing countries facing capacity constraints in accessing climate finance.

Despite international commitments to increase climate finance flows to the most vulnerable countries, Small Island Developing States (SIDS) and least developed countries (LDCs) struggle to access critical funds. CFAN was established to address the barriers these countries face by placing advisors highly trained in project design and financial structuring directly within host ministries.

There is an urgent need to improve the way climate finance is accessed and delivered, particularly to the most vulnerable and capacity-constrained developing countries. Although the volume of climate finance flowing from developed to developing countries has increased, the system for accessing that finance has become highly complex. Most small or low-income countries lack sufficient capacity to navigate the system, resulting in a climate finance bottleneck that is mutually frustrating for those providing finance as well as those trying to access it.

CFAN supports developing countries in securing and structuring finance for climate investments. By cultivating a network of highly trained, embedded climate finance advisors, CFAN builds the capacity of developing countries to more quickly access climate finance and achieve their climate objectives. Ultimately, CFAN ensures that more countries have access to advisors who are better prepared and better connected to both donor institutions and other advisors around the world.

Governance

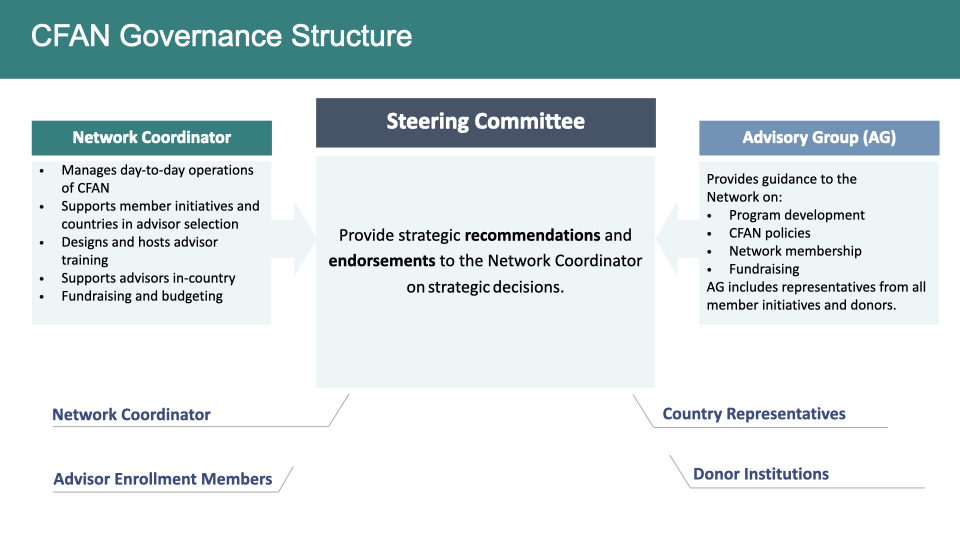

CFAN is a global network that brings together developing countries, donors, institutions, and regional and international organizations. To ensure additionality and reduce costs, CFAN partners with existing initiatives and organizations experienced in building in-country climate finance capacity.

CFAN is managed by a network coordinator, currently RMI — founded as Rocky Mountain Institute, RMI is an independent, non-partisan, nonprofit organization. The Network is guided by a Steering Committee and Advisory Group comprised of member initiatives, country representatives, and donors. Details on each of these roles and their responsibilities can be found below.

- Coordinating country demand for advisors

- Supporting member initiatives and countries in advisor selection

- Designing and hosting the advisor training

- Supporting advisors in-country

- Ensuring in-country knowledge transfer

- Fundraising and budgeting

- Program development

- CFAN policies

- Network membership

- Fundraising

- Country selection

- Advisor enrollment

- Annual budget and fundraising

- Workplan

- Hiring/staffing

- Contracting

The Network Coordinator manages the day-to-day operations of CFAN, including:

The Network Coordinator also chairs the Advisory Group and Steering Committee and is responsible for scheduling and coordinating member input to meetings.

The Advisory Group provides guidance to the Network on:

The Steering Committee provides guidance and recommendations to the Network Coordinator on strategic and operational decisions that include:

CFAN Services

CFAN offers key services to its member initiatives, advisors, and the countries it supports. These fall into four main categories:

-

Advisor Training

CFAN hosts a multi-week cohort-based training for climate finance advisors.

-

Advisor Support In-Country

CFAN provides on-demand technical support to advisors working in-country. CFAN also maintains connections between advisors, encouraging peer-to-peer learning.

-

Capacity-Building In-Country

CFAN Advisors deliver in-country trainings for civil servants, building capacity in-country beyond the tenure of the Advisor.

-

Network Coordination

CFAN improves coordination across existing organizations while also identifying demand for climate finance advisors, reducing duplication, and ensuring additionality of services.